Contracts for Difference (CFD), leveraged over-the-counter products, do not have the best reputation, nor do some relevant CFD brokers. As a result, mandatory warnings such as “66% of retail investor accounts lose money trading CFDs with this provider” may not come out of the blue. So is there a use case for CFDs, and why do so many retail investors seem to lose money with this product?

There are many possible reasons why investors lose with CFDs and Forex. One of the main reasons is certainly, without being able to support this with data, that they have not thoroughly studied their strategy, or the trading activities are quite fundamentally lacking a system. In this respect, there is no difference between CFDs and, for example, stock trading. The disadvantage for the CFD investor is, in any case, the headwind in the form of interest on the borrowed capital. In addition, CFDs are often used for speculation in the foreign exchange market (Forex), where it is tough to survive as a private investor due to the efficiency of this market.

So let’s start with the question of why many investors lose money with CFDs (and) on the Forex market. In our view, there are two main reasons for this.

Overtrading

Of course, this “classic” is not a mistake specific to forex trading but seems very common there. Many forex brokers allow you to trade with small amounts of money and high leverage, which tempts unsophisticated investors into a kind of lottery mentality. Moreover, the low fees give the impression that individual trades are almost free, which is not the case. The cost per trade may only amount to a few “pips”. Still, these costs almost inevitably lead to losses without an exact plan of when to trade (so that one trades too frequently rather than too infrequently). The profit margin is usually very small in forex trading, as we will illustrate later.

For many trades without a proven strategy, the many small losses in the form of transaction costs combined with an expected value of the individual trade of about zero will almost certainly lead to losses in the long run. And without rigorous, methodically clean strategy development, which is extremely difficult to achieve as a lone wolf, the vast majority of strategies used by private investors have an expected value of zero. This brings us to the second reason.

What is the expected value of one’s strategy?

Why do most investors, including us, prefer to invest in stocks or ETFs as primary investments? Because a stock represents a part of a company, and thus the value of the asset is underpinned by reality. So the investment case is clear: you are providing capital to a company that you hope will use it profitably to grow. While this may not be true for every single company, it is at least true on average across the economy and in the long run. The investor takes some risk by potentially investing in a failing company. Still, there is a reward for doing so in the long run: that’s a risk premium! This risk premium is also evident in loans, where higher-risk loans typically yield higher returns.

But where is the risk premium in foreign exchange? It’s like investing in commodities with no cash flow or growth expectations. So buying and holding is not enough because there is no inherent risk premium in the foreign exchange market. At least not one that is readily available. Instead, many forex traders seem to resort to outdated methods with low or no expected value, such as technical analysis, without sufficiently questioning these methods. In the highly liquid (read: efficient, as all available information is priced in) forex market, these essentially random trades, as discussed earlier, lead to losses in the long run, as many small fees are incurred for transaction costs.

Risk premium in the foreign exchange market?

It could be argued that there is also a risk premium in the foreign exchange market. However, if there is such a premium, it cannot be exploited as simply as in stocks. For example, depending on global trading hours, there could be specific time windows within which it is more or less risky to hold certain currencies. This could lead to systematic price movements that could be exploited, at least in theory. In practice, one would have to test if the effect survives the transaction costs.

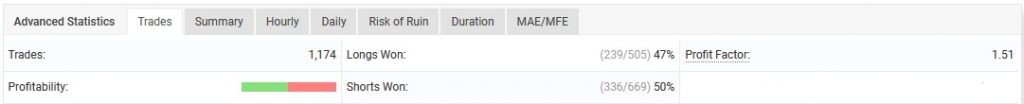

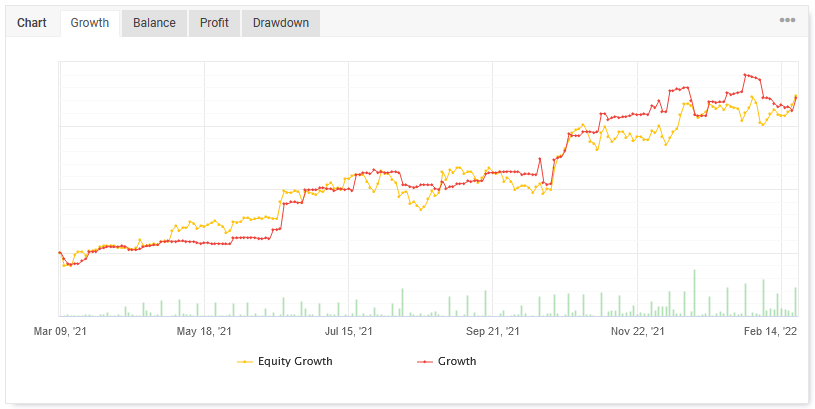

Statistics of an automated Forex strategy

This is an example of the 12-month performance of an automated Forex strategy implemented with CFDs. The strategy has been running very successfully lately, as you can see, even though there will probably be deeper drawdowns in the future. At least, the backtest suggests that this was one of the better phases of this strategy.

To have such expectations and benchmarks, the research and automation development up front was crucial! The relatively high number of 1174 trades at various times of the day (and night) would be impossible to trade manually.

Solid research and its strict implementation are everything – gambling with CFDs based on technical analysis, gut feeling, or the latest hot tip from a podcast is nothing. Moreover, as we mentioned earlier, this is a good illustration of how competitive the forex market is. The individual trade has only a small positive expected value for strategies with a higher frequency. This expected value also usually continues to decline over the years (“alpha decay”).

What about CFDs on stocks?

We have now talked a lot about Forex CFDs, but there are CFDs on many types of assets, such as stocks, ETFs, indices, and commodities. In terms of stocks, there should be little controversy that a risk premium exists that can be profited from via buy-and-hold. However, investing in stocks via CFDs has the disadvantage that CFDs incur financing costs on the borrowed capital, which allows for leverage. If you can use the leverage to create profits that exceed the additional cost, the obvious choice is to use CFDs. However, to be honest, most private investors are not in this situation and fare better with the conservative option of investing either broadly in stocks or in ETFs. Analogous considerations could be made for most other asset classes.

CFDs for hedging exchange rate risks in stablecoin lending?

To mention an entirely different possible application of CFDs, here is an example: Hedging exchange rate risk.

Indeed, the interest on the capital borrowed via CFDs is not insignificant at currently around 2%, depending on the currency pair and other parameters. However, the interest rates in the crypto market for stablecoin lending are presently (still) much higher.

Besides smart contract risk and counterparty default, risks are usually the exchange rate, as there are still only a few ways to lend stablecoins on Euros. The best lending opportunities are still for stablecoins on US dollars, for example, USDC.

This exchange rate risk could be hedged using different products. The obvious would be ETFs, futures, or CFDs. ETFs, even leveraged ones, have the disadvantage of tying up a lot of capital and thus significantly lowering the return. Futures would be a more capital-efficient alternative, but due to the high nominal value of usually >50,000 €, they allow less precise hedging than CFDs and are only suitable for correspondingly high investment amounts.

An example for hedging the exchange rate risk of USDC stablecoin lending via CFDs on EUR/USD at Darwinex:

- Lending of 10,000 USDC with 10% annualized return (APY)

- Hedging by buying/long Darwinex EUR/USD CFD

- 10.000 $

- Margin 3,33 %

- daily swap interest payment approx. 0.5 $

So we lend 10,000 USDC at an interest rate of 10% and hedge the exchange rate risk by buying an equivalent dollar amount in CFDs on EUR/USD, thus being short USD in the CFDs. We neglect the commission of €2.50 here. How does this affect the return at the end of the year?

- Interest income from lending: 1.000 USDC

- Interest payments for CFD: 365 * 0,5$ = 182,5$

- Capital employed for CFD with margin of 3.33% and margin level of 200%: 666$

- Total capital employed = 10000$ + 666$ = 10.666$

- Net return = 1000$ – 182,5$ = 817,5$

- Return after costs: 817,5$ / 10.666$ = 7,7%

So the net return drops from 10% to about 7.7%

We have assumed a margin level of 200% here to ensure some buffer to the margin call at <100%

From a tax point of view, to our knowledge, it should be noted that such hedging costs for the private investor in Germany cannot be offset against the income from lending, as CFDs are forward transactions. However, in one’s own trading company, it is possible to deduct the possible losses from hedging with the associated interest and transaction costs from the profits of the GmbH and thus reduce the tax burden.

Conclusion

Hopefully, this discussion has made it clear that it is somewhat undifferentiated to demonize CFDs across the board. Instead, a suitable strategy is the be-all and end-all. On the one hand, in the stock market, where at least with long-only systems and before transaction costs, there is still a positive expected value, but on the other hand, especially in the foreign exchange and commodity market.

With stocks, one can get away from having to make profits via elaborate strategies by collecting risk premiums by buying and holding, which is not so simple in the Forex market.

The bad reputation of CFDs and Forex stems from the fact that the opportunities they offer are mostly misused. Unsystematic and excessive trading leads to the accumulation of transaction costs, which are a headwind that is difficult to overcome in efficient markets in the long run. Realistically achievable profit margins accessible to retail investors are, in our experience, so small that, contrary to the impression readily conveyed in broker webinars, successful strategies must be carefully crafted and extensively tested to average at least a few pips per trade. Most private investors are better served by pursuing simple, proven, long-term strategies in the stock market first and foremost. Only if more proven strategies are already part of the portfolio, strategies on the foreign exchange market can be useful as an add-on.