Opening a corporate account with Interactive Brokers, for example for an asset managing limited liability company, is slightly different from opening a private account in terms of the required documents. In addition, Interactive Brokers (IBKR) presents us with slightly different dialogs, which we will go through step by step.

The following account opening process including all screenshots shown is as of April 2021 for a German GmbH (LLC) and is of course subject to change. Accordingly, some of the text on the screenhots is in German. Generally, this article is intended to serve as an orientation and preparation for opening an account, as the entire process is unfortunately somewhat unwieldy.

What documents are needed to open a business account with IBKR?

The following documents are required to open a business account with InteractiveBrokers.

Personal documents for all shareholders

- Identity card / passport / driver’s license

- Address confirmation, e.g., utility bill, bank statement or registration certificate

- Selfie with identity card

- Personal tax IDs for all shareholders

Company documents

- Address confirmation, e.g., bank statement, letter from bank or consumption invoice

- Commercial register excerpt

- List of shareholders

- Corporate Structure Chart showing the shareholding structure of the company (example later in the article)

- Tax number

By clicking the following button, you will be redirected to open an account with InteractiveBrokers and receive $1 in InteractiveBrokers shares for every $100 deposited and held for at least one year. The maximum bonus is $1000. We will receive compensation if you use the account to a certain minimum extent.

Opening an IBKR account for a small company

To open an account for a German limited liability company, we choose to open an account for small businesses at https://www.interactivebrokers.eu/de/index.php?f=46612

During the opening process, it is a good idea to chat with support if you have any problems. This works well, although during our attempts the chat was always available in English only. As a side note, of course, the chat staff generally does not provide information as soon as it comes to tax-related issues, such as the FATCA document, which we will explain later.

Since opening an account for a limited liability company is a bit more involved, it is useful to know that you can easily resume the account opening process if it has been interrupted. To do this, click on “Open Account” and “Finish an Application” on the InteractiveBrokers home page.

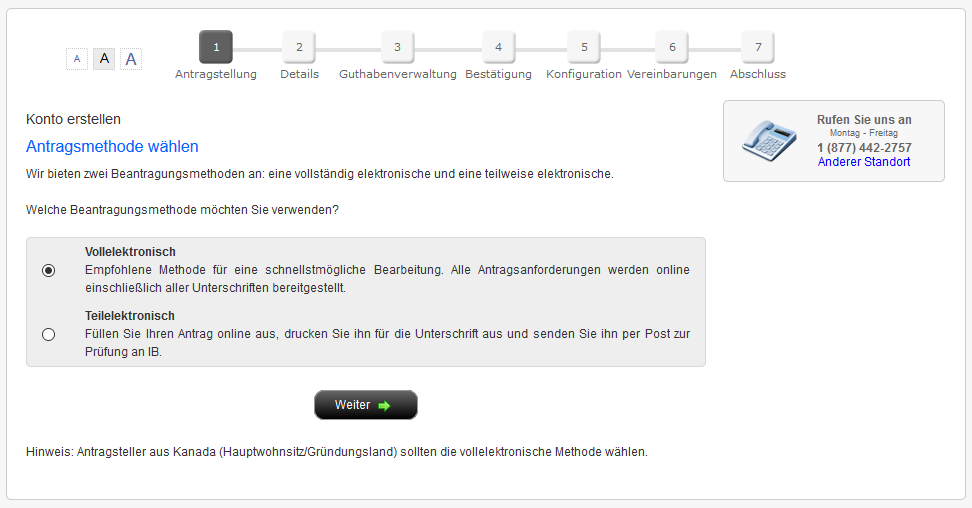

In the next step, we choose the fully electronic version of the account opening:

Create user account and select company form

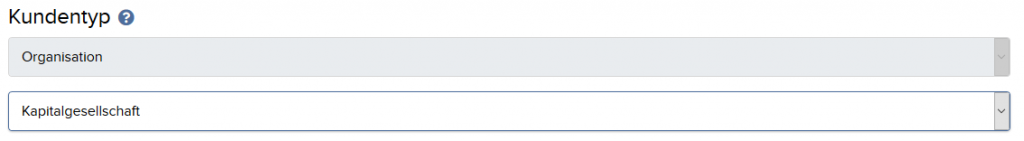

First we need to create a new user account or log in to an existing account. Then we select “corporation” as the organization type for our limited liability company accordingly.

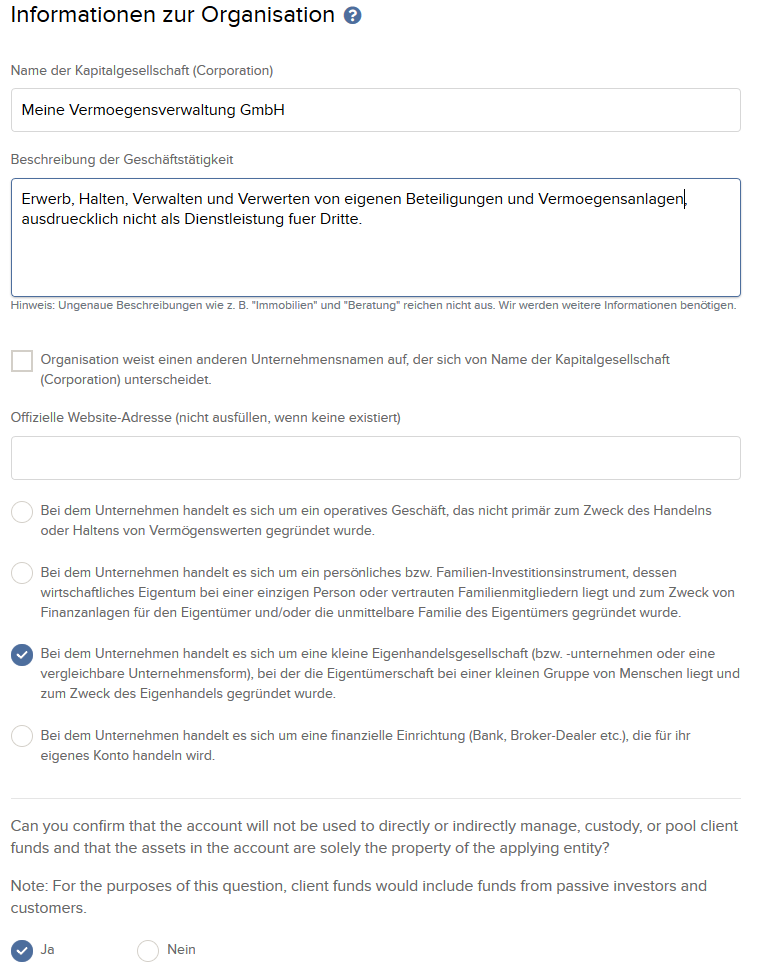

Information about the organization and description of the business activity

Now some basic queries about the company follow. As a description of the business activity, for example, the company purpose stated in the articles of association is suitable. In addition, the company should be classified into one of four categories. In the case of a trading limited liability company, it will usually be a company in the sense of points 2 or 3. Important: Do not use German umlauts or other non-English symbols in the text fields when opening an account for Interactive Brokers!

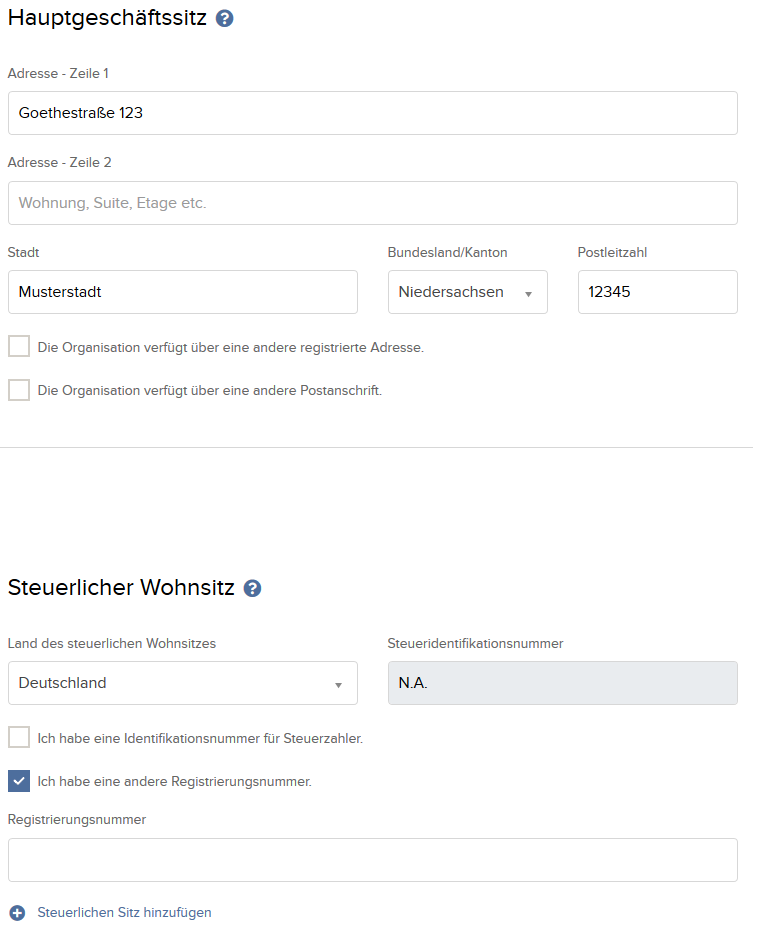

Filling in the contact details probably does not need any explanatory words. In addition, IBKR asks for the “Tax ID“, which, however, is only assigned to natural persons in Germany. In the case of a limited liability company, the tax number can be entered under “I have another registration number”.

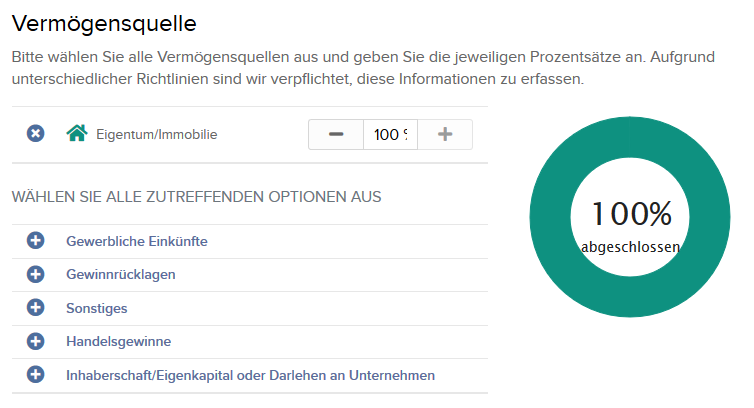

As a source of assets, for example, 100% “Savings” can be indicated under “Other”. In any case, the information should be truthful, as in our experience IBKR will ask for further details by e-mail.

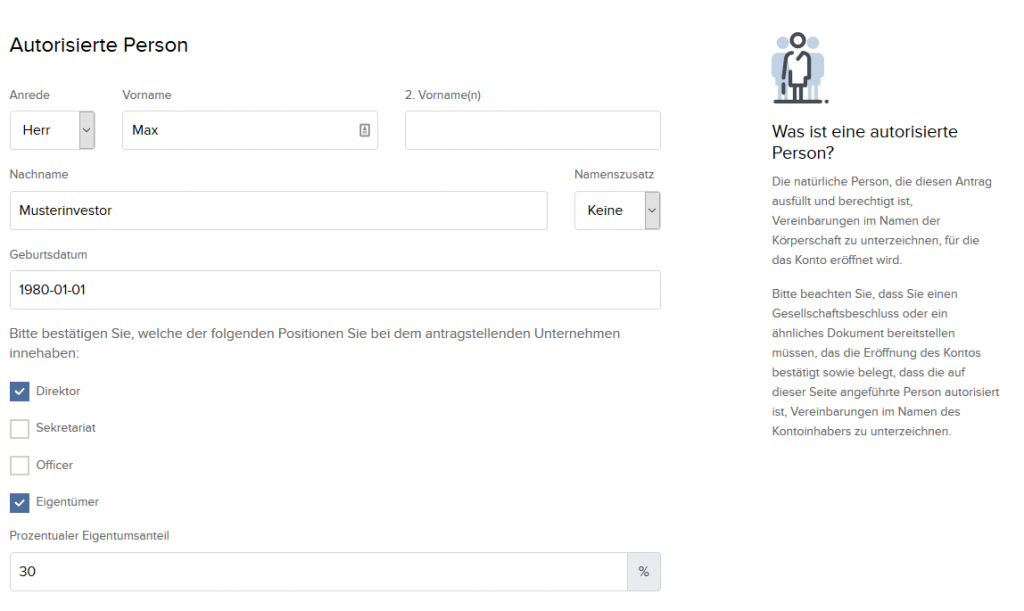

Authorized person

This page should be self-explanatory: an authorized person must be indicated, for example (one of) the shareholders.

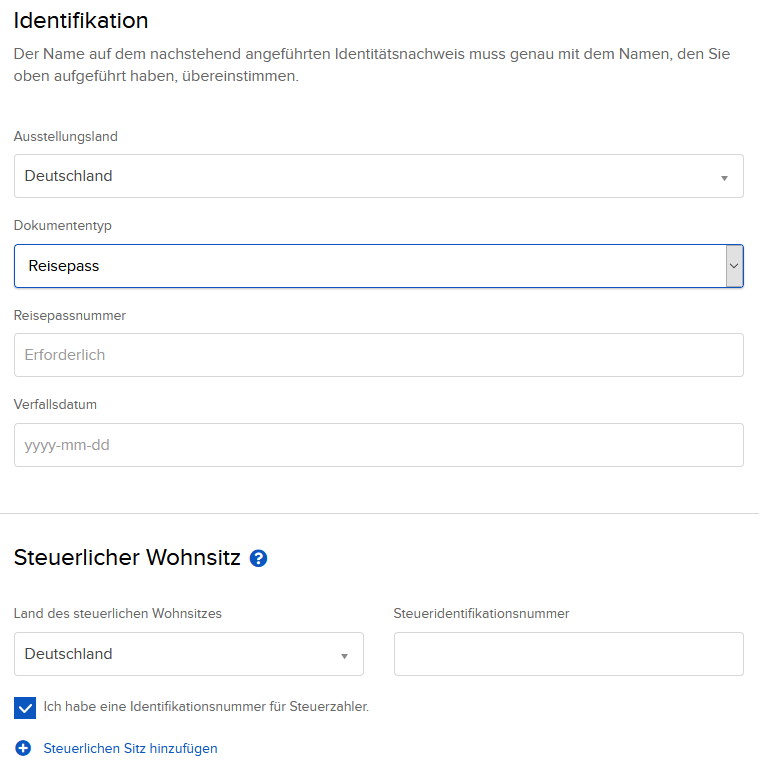

This is followed by the usual personal identification and tax residency information. The tax ID should be given as the identification number.

In addition, the employment relationship is requested (not shown here).

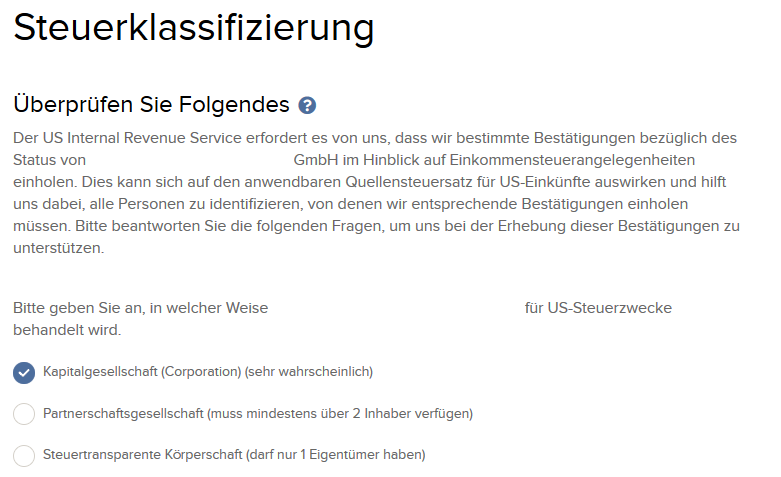

Tax classification of the company

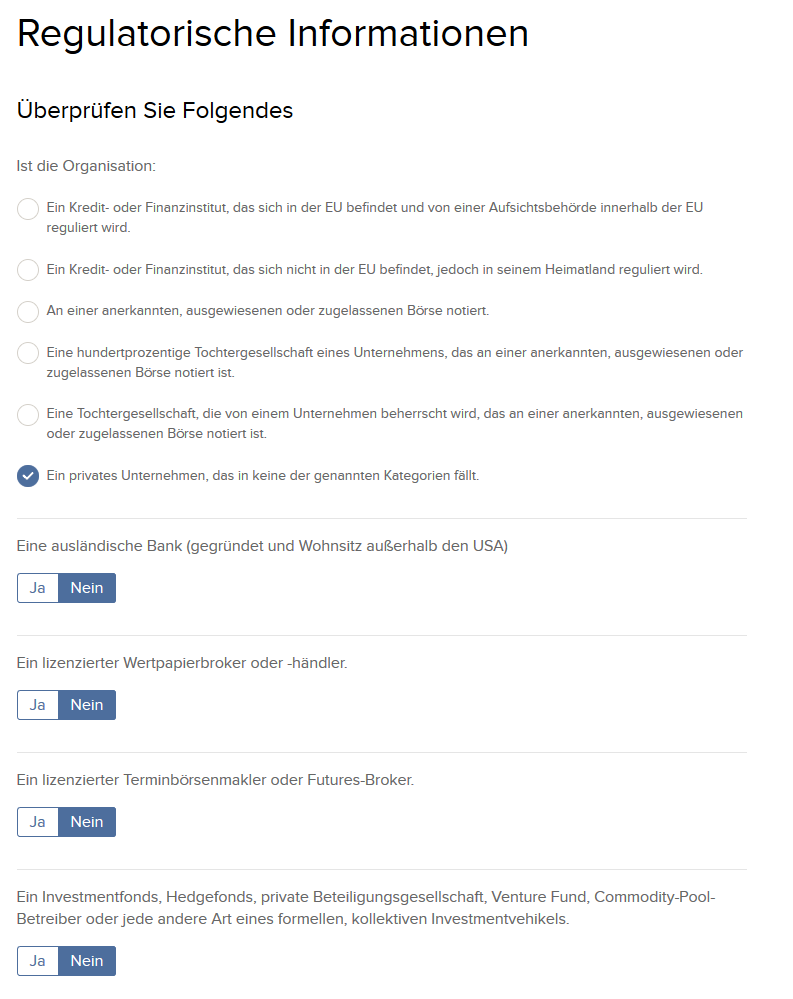

Regulatory information

The next page contains several yes / no questions, all of which can normally be answered with “no” in the case of a German Trading-GmbH.

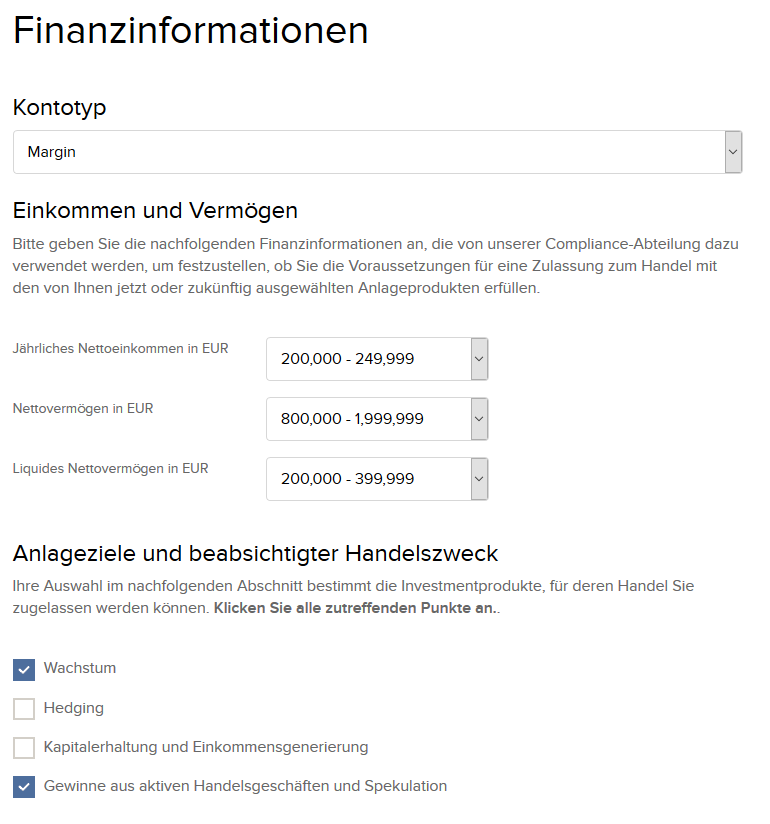

Financial information

Important on the next page “Financial information” is the selection of the account type. Here you can choose between a “normal” account without leverage and a margin account. “Margin” here usually refers to “Reg T Margin”, under which up to 50% of securities purchases can be credit financed. Maintenance margin is 25%. For those who are unclear about how trading on margin exactly works or whether a margin account would make sense, we advise against it at this point. InteractiveBrokers provides an explanation and examples here. The account can still be changed to a margin account after opening.

A somewhat higher leverage can usually be achieved by portfolio margin. Here, the necessary margin, as the name suggests, is calculated on a portfolio basis. However, portfolio margin requires a minimum capitalization of the account. Again, it can still be applied for after the account opening.

Secondly, the information on income and assets and the product selection are important. This too can either be completed right now or further customized after the account opening. The trading of certain products, usually those of a more speculative nature, is subject to various thresholds and criteria regarding income, investment objectives and assets, which can be found here. For example, for a Reg-T account, the minimum annual income is $40,000 and the minimum assets are $20,000.

At Interactive Brokers, the category of “Complex & Leveraged Products” includes leveraged ETFs, inverse ETFs and ETPs, see here. This requires at least “good” experience for stocks and options (or just one of them if an additional quiz is taken to complete the account opening)

To trade Complex & Leveraged Products, you must have a minimum of two years trading experience with stocks and either options or futures, or with stocks or options or futures and take a test.

Example of a requirement for Complex & Leveraged Products

If more than one shareholder is involved in the company, the assets and income of the shareholders can be added at this point.

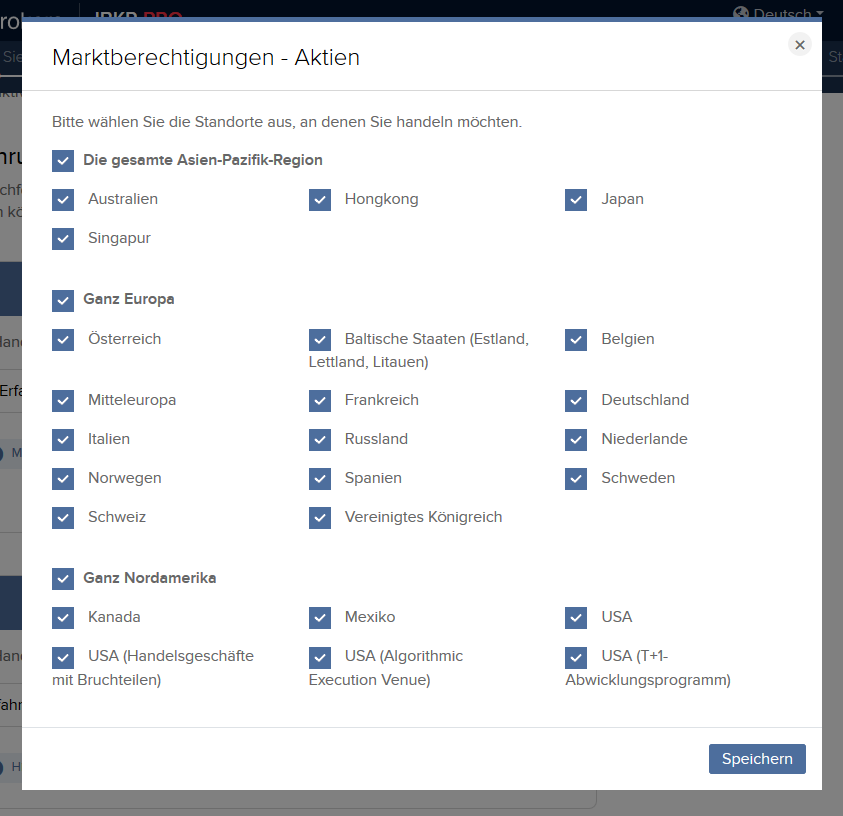

By clicking on “Add” you can select the stock markets:

Currency conversion, for example to be able to buy US stocks in dollars, is enabled by default and cannot be disabled.

The “Return Enhancement Program” makes the shares available in one’s own portfolio to lend to other investors, which is usually used for short selling. We have not activated this option as a precaution, but have no experience with it.

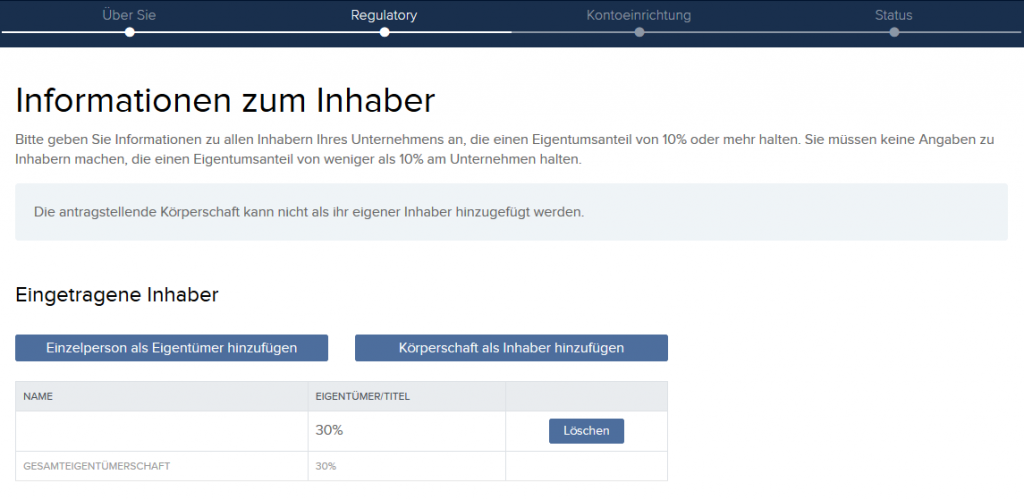

Registered holders

Here, the personal information of all shareholders with a share of 10% or more must be entered. A bit annoying: After clicking on “save” the entries can no longer be edited, but only deleted and created again.

Again, all the usual data is required for this: Name, address, position in the company, nationality, share in the company, employment relationship, source of assets, etc. Once again, an identity card, driver’s license or passport (no. and expiration date) serves as the means of identification. In addition, the tax ID must be provided.

Certification regarding beneficial owner of legal entity clients

The next page is apparently used to fulfill regulatory requirements regarding money laundering.

Person with authority to issue instructions

One of the shareholders can be selected here via drop-down.

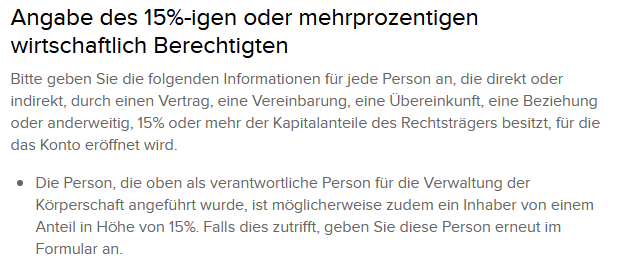

Beneficial owner with a share of at least 15%

All shareholders with a share of 15% or more must be specified. In the case of an independent limited liability company, you will be asked again for the shareholders that have already been entered on the previous pages. The form should already be correctly pre-filled.

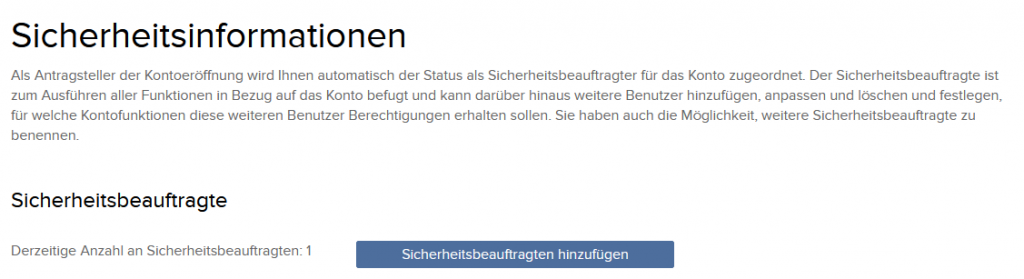

Safety representative

Here one or more “Security Officers” can be created. However, the security officers need a user account at IBKR, so personal data alone is not enough.

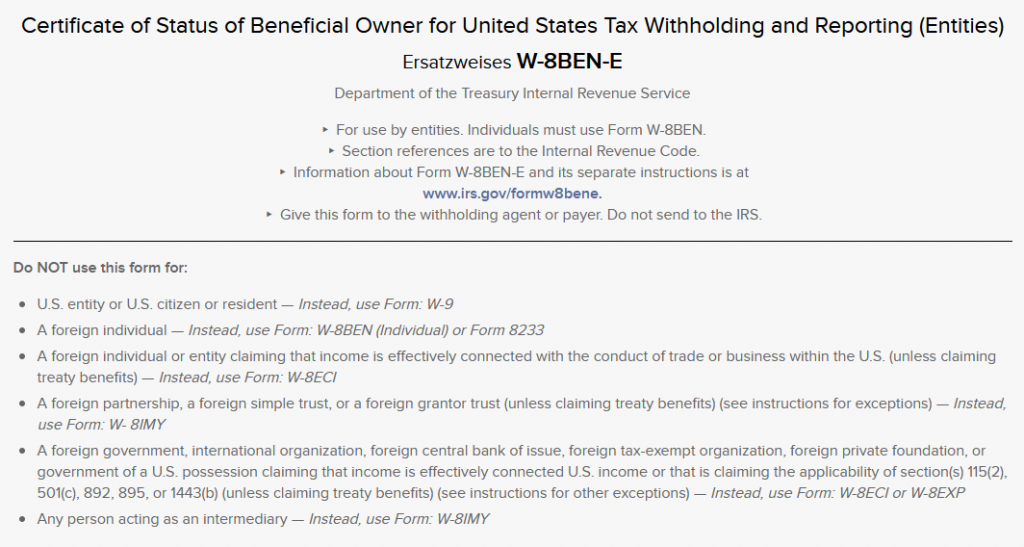

Form W8-BEN-E at Interactive Brokers for corporate accounts

Form W-8BEN-E, which is unfortunately a bit confusing at first glance, is usually obtained by US companies in order to correctly forward any withholding tax (e.g. on dividends). Although only a few details are required, some background knowledge is necessary to fill out the form correctly, especially with regard to these two classifications:

- Type of company (active, passive, etc.)

- Basic rules for claiming benefits from a tax treaty

Let us reiterate that this article describes the account opening for our German LLC. This is no financial or tax advice and regulations in your country may differ.

Is an asset managing GmbH a passive non-financial entity (NFE)?

As a rule, German asset managing or trading GmbHs are passive non-financial entities (NFE). The company is “active”, if more than 50% of the gross income of the previous calendar year was generated by the sale of products or services. This is a threshold that most trading companies are unlikely to reach.

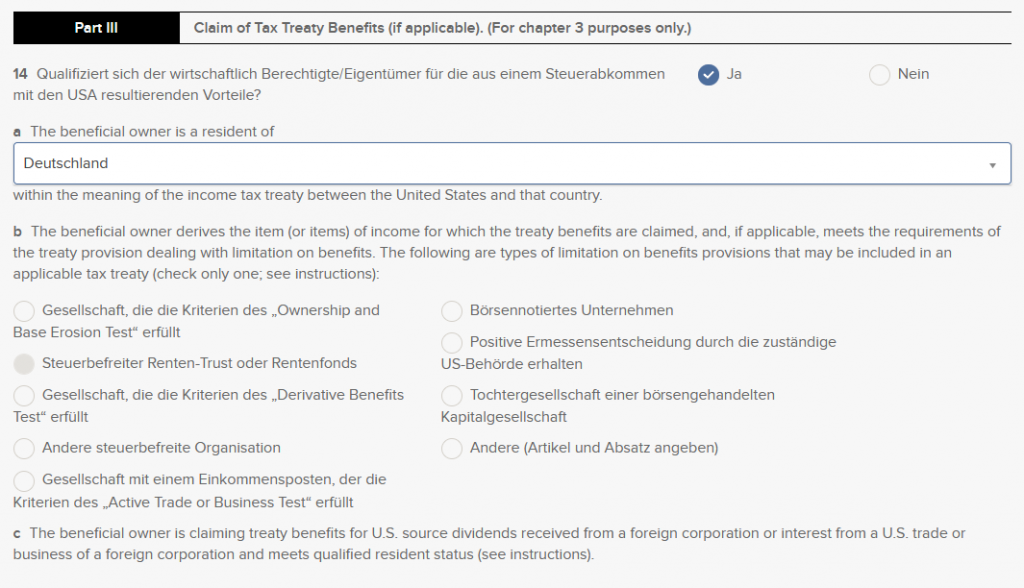

Claim of Tax Treaty Benefits

In order to enjoy the benefits of the double tax treaty, the reason why the double tax treaty applies to the particular GmbH must be selected in Part III. In the case of a German asset-managing GmbH whose owners are also German citizens, the “Derivative Benefits Test” can be applied:

The Derivative Benefits Test is met if more than 95% of the total voting rights and of the value of all shares in the company are held directly or indirectly by seven or fewer beneficiaries. The beneficiaries must be resident in an EU, EEA or NAFTA member state and could claim the same benefits under their double tax treaty with the US (Credit Suisse DTA info).

Otherwise, it would have to be checked whether the GmbH possibly meets the base erosion test: It is passed if, among other things, at least 50% of the shares in the company are held by private individuals who are residents of the treaty country.

The following special rates and conditions can generally be left blank.

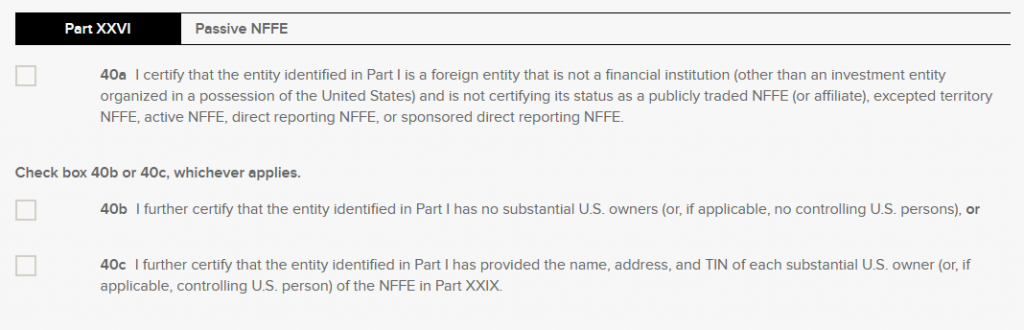

As a passive NFFE, one must finally confirm that there are no U.S. participants, as this is mainly about them. Otherwise, extended disclosure obligations may apply. 40a should generally apply.

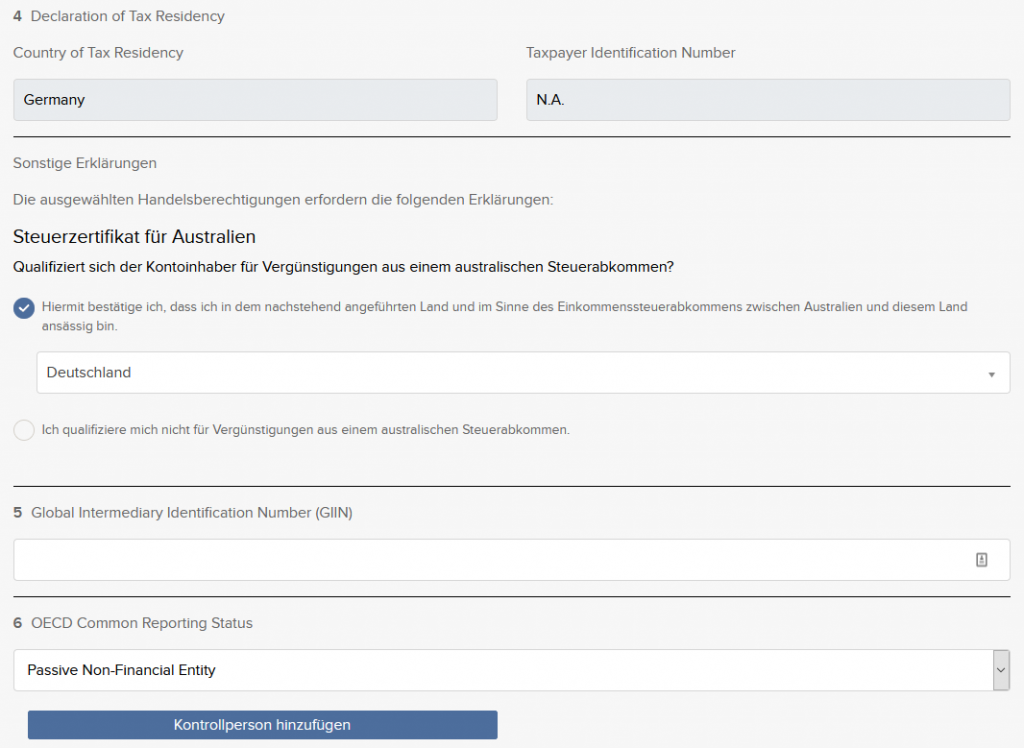

Certification of Entity Tax Residency

This is followed by another form that relates to the double taxation agreement with Australia. Here, it is only necessary to confirm that the company’s registered office is in Germany.

As control person (which must be added obligatorily) the managing shareholder can be indicated in the Designation as Senior Management Official and with Signing Capacity as Representative of Entity.

Completion of the account creation

On the last page, numerous “Terms and Conditions” must be confirmed. In our opinion, no surprising clauses were hidden here, but as always, better check the fine print yourself.

“Your tasks”: Upload documents

Almost there… This is the last page of the account opening process, listing all the other documents that are required. In the case of a limited liability company, these are unfortunately quite a few, so here is the overview of what documents are involved and what is suitable as proof.

The documents that need to be uploaded for opening a limited liability company account with InteractiveBrokers are in detail:

- Proof of address of the main place of business, e.g. scan of a utility bill or a letter from the tax office

- Proof of registration in the form of an extract from the commercial register (in our case, no notarization of the extract was required)

- Proof of identity for the shareholders, e.g., scans of their identity cards

- Proof of address for the shareholders, possible through certain documents showing the full address, e.g., bank statement, electricity bill or registration confirmation from the municipality

- Signing of document U4632741(CERTIFICATE AND RESOLUTION TO OPEN INTERACTIVE BROKERS ACCOUNT) linked on the question mark

- Proof of Eligibility for Margin Trading: IB also provides a document for this purpose, which must be signed, scanned and uploaded again. In addition, proof of the authority of the person who signed the document is required (e.g., Memorandum and Articles of Association or list of shareholders from the Commercial Register)

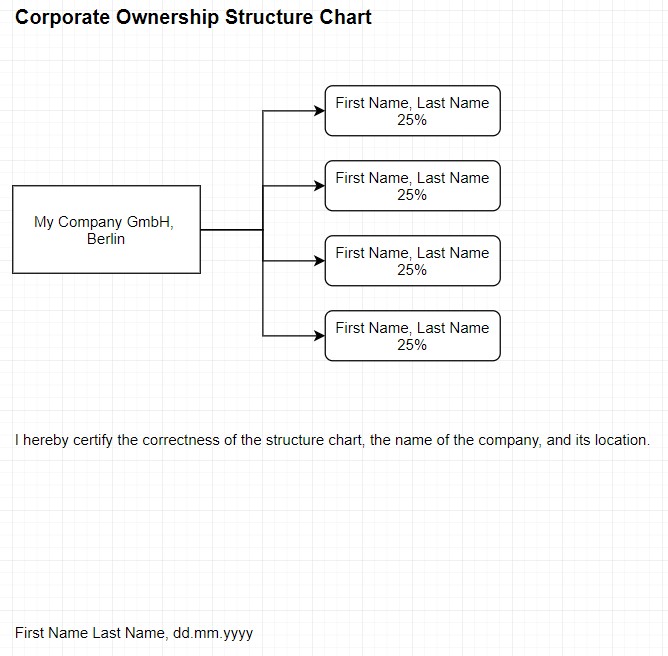

- Ownership Structure Chart: a schematic representation of the structure of the company, which is of course very simple in the case of a structure without a holding company or similar. We have provided a template for Draw.io (an online tool for illustrations, graphs, etc.) here, which can be used to create the Ownership Structure Chart shown below.

Also, any tutorials need to be completed.

So, as you can see, opening an account for a limited liability company can be significantly more involved than for an individual. Therefore, we hope that this article gives a good impression of the effort involved and has already clarified some questions.

Thanks for sharing the steps it takes and the effort required.

Hi Arturo, you’re welcome! Thanks for your comment. I’m glad you found the post helpful.