Darwinex is a forex broker based in England. The product universe mainly includes the typical instruments of an FX broker. However, larger US stocks are currently made accessible via integration with Interactive Brokers. However, this process is still in its early stages. Darwinex increasingly advertises “Darwins”, which are a vehicle to invest in the strategies of other investors, i.e., social trading. However, the main argument in favor of Darwinex are the fair fees.

What documents are needed to open a limited liability company account at Darwinex?

To open a company account at Darwinex, a standard user account must first be created as a “Trader”. However, the subsequent account opening of a live account is only for private investors. Additional information is required to open a business account.

For this, Darwinex currently (February 2021) does not provide a dialog on the website. Instead, one must first contact customer service and ask to receive the document for opening a business account. The required information is:

- Legal Entity Identifier (LEI).

- Copy of register of shareholders: A document is required on which all shareholders with a share of at least 25% are listed, e.g., in the case of a German GmbH a commercial register extract including the list of shareholders. Certification of the documents is apparently not mandatory.

- Proof of Registered address (“original utility bill or bank statement displaying the Company’s Name and Registered Address dated within the last 3 months”).

- Copies of identity cards or passports and tax numbers for all directors and shareholders with a shareholding of 25% or more

- Proof of Address for all directors and shareholders with a share of 25% or more. Suitable are again consumption bills, e.g., an electricity bill, or a registration certificate, which can be issued by the town hall at one’s place of residence.

Application document for company accounts with Darwinex

The Corporate Account Application Form provided by Darwinex contains slightly different details on the documents required, but in our experience only the documents from the above list are necessary.

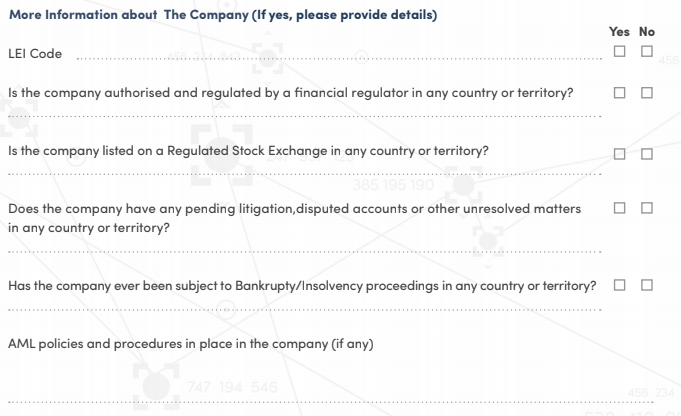

In addition to the usual information, such as address details, there are some additional questions to be answered that are directed at companies.

- Yes: LEI codes are also required by other brokers to open an account

- No: An asset managing GmbH or UG, which serves the purpose of private investment, is generally not regulated by BaFin

- No

- and 5. hopefully also “No”…

The field for AML policies (Anti Money Laundering) can be left blank.

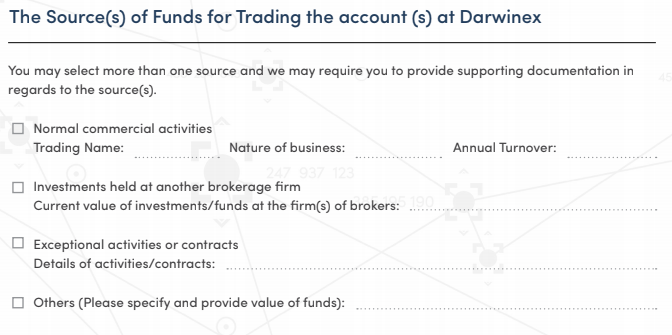

On the next page, there are questions about the financial classification of the company.

Then, as with Interactive Brokers, for example, questions are asked about the source of funds. In the case of an asset-managing limited liability company founded for private purposes, it should be sufficient to enter private savings or income from employment under “Others”. However, these pieces of information should be correct, as some brokers later demand proofs.

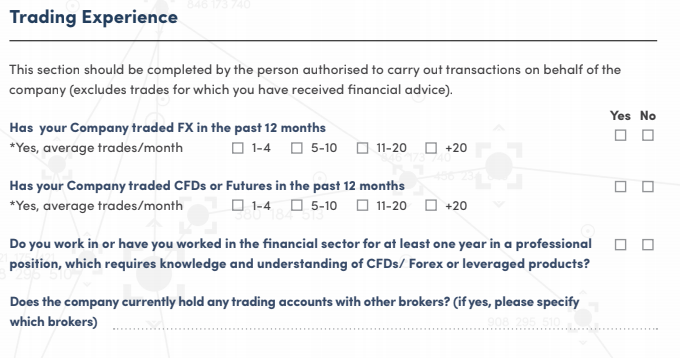

After some questions about the planned trading activities, which should simply be answered truthfully, and the personal data of all persons who will have access to the account, some questions about classification of trading experience in relation to the company follow. Especially in the case of a newly established limited liability company, of course, there is no history here, so the questions would have to be answered with “no”.

It is important to note that a low classification does not lead to the rejection of the application, but only reduces the chances of being classified as a professional investor, which would allow a higher leverage. Otherwise, and for individuals, the leverage is 30 for EUR/USD, for example.

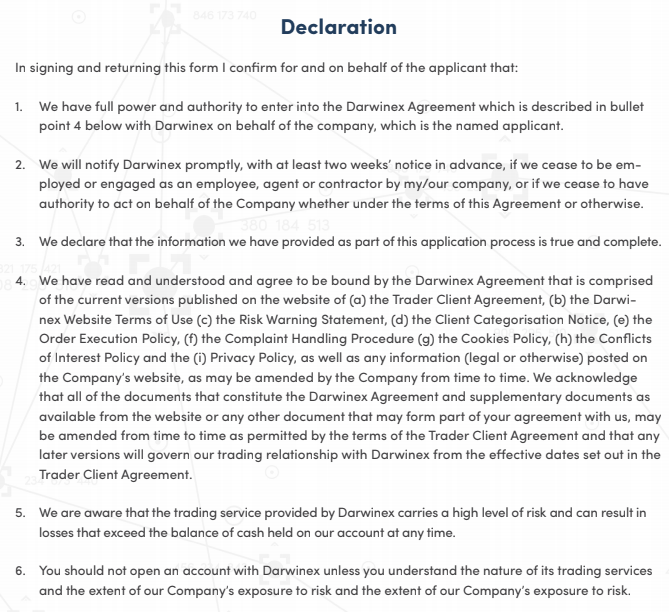

Finally, two general statements must be accepted.

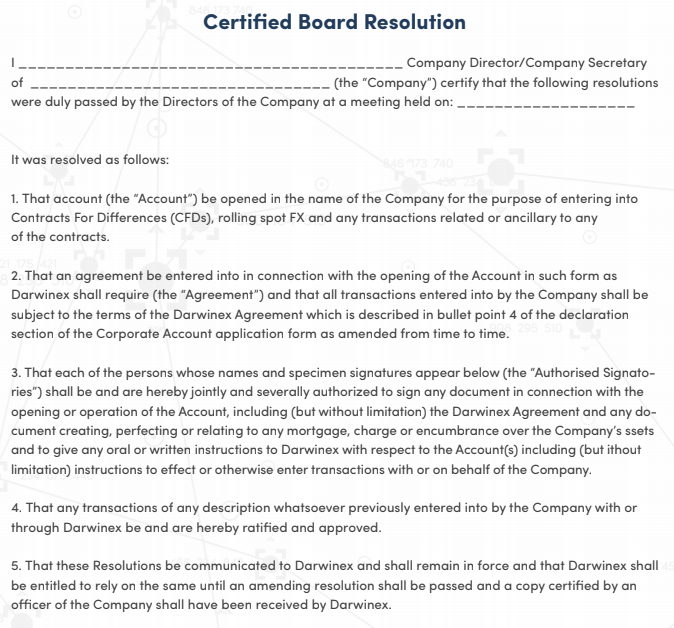

And secondly, a shareholder resolution must be passed and signed confirming that the company intends to open an account with Darwinex and transact within the terms and conditions.

How do deposits and withdrawals work?

Deposits can be made by bank transfer to Santander UK. Transfers of €500 or more are free of charge, below that a fee of €5 will be charged. In our experience, the processing time until crediting was recently one or two business days.

The minimum deposit for business accounts at Darwinex is $10,000.

Withdrawals, assuming validation of the deposited checking account, also take a few business days in our experience and cost 3.75₤ (currently about €4.30).

After a deposit has been credited, the money can be transferred to one of the “Trading Accounts”. These are the individual “Meta-Trader accounts”, of which any number can be created. In order to make a withdrawal, the money must be moved from the Trading Account to the wallet in reverse order. All these internal transactions are free of charge and take place in real time.

What are “DARWINs”?

DARWINs are social trading vehicles that bundle someone else’s trades so that you can participate in that trader’s performance. They can be useful in some cases, but we consider it generally not advisable to invest in them for the following reasons.

1) You have no control over what exactly the selected trader will do in the future, and

2) There is always more than one way to invest – whether through algorithmic strategies or with traditional methods like buy-and-hold of stocks. So before exotic alternatives like DARWINs make their way into the portfolio, one should ensure that this fits one’s investment goals and that the risks are understood. With this in mind, DARWINs would not necessarily be far “up our list.”

Darwinex has put some effort into risk management for DARWINs, which we acknowledge, but judging from what we have seen and heard from investors, DARWINs are not necessarily better or worse than other “social trading” products – and these are notorious for highly volatile performance.

Therefore, our recommendation is to take advantage of the low fees at Darwinex and leave DARWINs aside or keep your positions small.