An LEI (Legal Entity Identification) number has become mandatory for an asset managing limited liability company that is trading in securities since 2018 with the introduction of MiFID II. Here are our experiences with applying for an LEI for a limited liability company, a price comparison of some providers, the most important information about the LEI, and the exact procedure for applying. This article is written from the point of view of a German GmbH (a limited liability company), but might be relevant to companies from other regions as well. Please check with your bank or broker whether an LEI is required for a company from your region.

When do I need an LEI number for my trading company and how can I apply for it? In order to open business accounts with brokers as a GmbH, an LEI is required. The LEI can be applied for at one of the numerous providers at prices between 45 and 90 Euro/year, so it is an ongoing cost. The LEI provider can also take care of the renewal of the LEI.

The LEI is intended to create transparency in financial transactions between companies. Still, only a few details are required for the application. The process is quite standardized, so it should not make a significant difference with which of the providers the company applies for its LEI. One of the main differences, however, is the price.

LEI number price comparison (as of 2022-03-11)

The LEI of a company has to be renewed regularly, so the one-time application and thus a one-time payment is not enough. For this reason, we have listed the various subscription models of several providers here and given the costs not only for the initial application and renewal, but also as an example over a period of 10 years.

Longer subscriptions are usually the cheapest, but there are providers with a comparatively favorable subscription, for example the 3-year subscription from leinummer.de. There, the initial application is €50 and the renewal is €55 per year.

| Provider | 1. year (w/o tax) | Renewal per year (w/o tax) | Example: Total cost over 10 years (w/o tax) | Subscription duration |

|---|---|---|---|---|

| register-lei.de | 45 | 45 | 450 | 5 Years |

| www.leinummer.de | 45 | 49 | 470 | 5 Years |

| register-lei.de | 50 | 50 | 500 | 3 Years |

| www.wm-leiportal.de | 69 | 50 | 519 | 5 Years |

| www.leinummer.de | 50 | 55 | 535 | 3 Years |

| www.wm-leiportal.de | 69 | 55 | 564 | 3 Years |

| register-lei.de | 59 | 59 | 590 | 1 Year |

| www.lei.direct | 89 | 59 | 620 | 1 Year |

| www.leinummer.de | 59 | 65 | 644 | 1 Year |

| www.lei-manager.com | 49 | 69 | 670 | 1 Year |

| www.wm-leiportal.de | 69 | 69 | 690 | 1 Year |

| www.leireg.de (Bundesanzeiger Verlag) | 80 | 70 | 710 | 1 Year |

What is the LEI provider responsible for?

The LEI issuer (“LOU”, Local Operating Unit) takes care of the registration or renewal of the LEI at GLEIF for the asset managing GmbH or UG. The license fees incurred for this are typically already included in the stated costs.

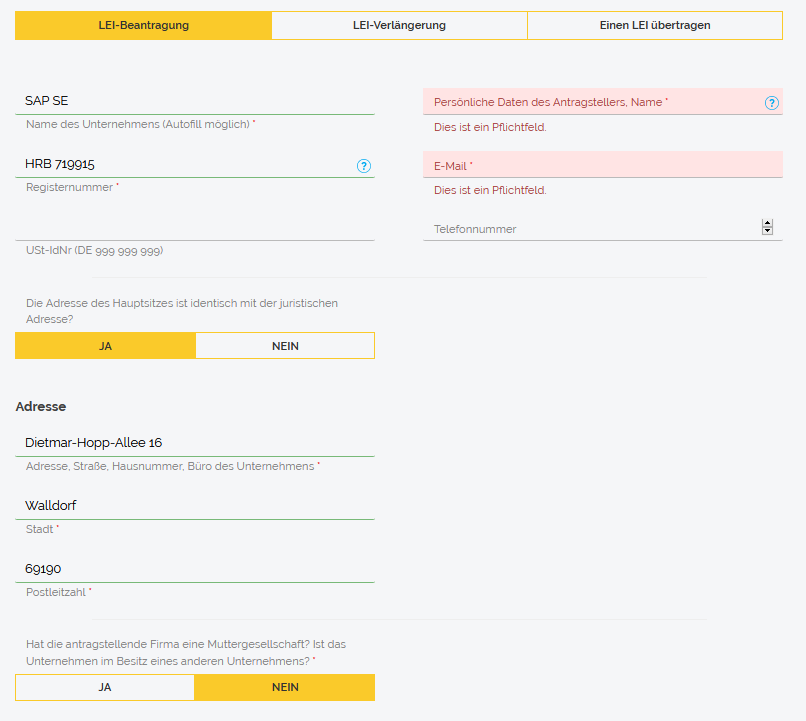

Our experience with registration at leinummer.de

The provider leinummer.de belongs to LEI Register OÜ from Estonia. The northern European country has become a digital economy with efficient processes, e.g. with regard to administrative acts such as company registrations, and a location for digital financial companies. The user-friendly interface of leinummer.de is one of the more modern ones.

In our case, the autofill worked, and the form should normally automatically transfer the information on the company’s registered office from the commercial register. No other information or documents were required.

After payment by bank transfer to a German bank account (in this case the Wirecard Bank, which, by the way, is not identical to Wirecard AG, but a subsidiary), a blanket request was sent by e-mail to send a payment confirmation, but this was not necessary and so the following day the newly assigned LEI was visible via the link to the order status and was also communicated to us by e-mail. A request to the customer service of leinummer.de in advance was answered within 24 hours. In the GLEIF database (Global Legal Entity Identifier Foundation), the LEI was listed about a day later and can then also be found via an LEI search.

What is the purpose of the LEI for an asset managing limited liability company?

… is a question that can rightly be asked, especially since we are all certainly trying to keep costs down as much as possible. Nevertheless, as far as we know, applying for an LEI is unfortunately unavoidable.

Even Wikipedia criticizes the triple notification in the form of mandatory publication of the annual financial statements, electronic balance sheet and LEI as “all the more absurd because the same company […] can be commissioned with the processing in all three cases”. Be that as it may – especially in Germany, we as serious investors now have to make an effort in advance in order to enjoy an improved compound interest effect in the long term.

In the course of the 20,000-page MiFID II Directive (“Markets in Financial Instruments Directive”), numerous regulations were passed, which concern, for example, requirements for the management of investment firms, admission requirements for regulated markets, reporting, transparency in share trading and admission of financial instruments.

Specifically, the information that is reported in transactions involving financial instruments is specified in the MiFIR regulation. As a managing director of an investment limited liability company, you fortunately do not have to deal with these details, as the broker takes care of the transmission automatically, but you should nevertheless have looked at the relevant data at least once.

Among other things, the reportable information under MiFID II includes:

- Quantity information and price quotation

- Date and time of the trade

- Currencies

- Legal Entity Identifier (LEI) for legal entities that are entitled to an LEI

- Classification of the instrument

- specific information on OTC derivatives

- Identifiers of short sales

- Result of the exercise of options

What information about a limited liability company is published in the GLEIF database?

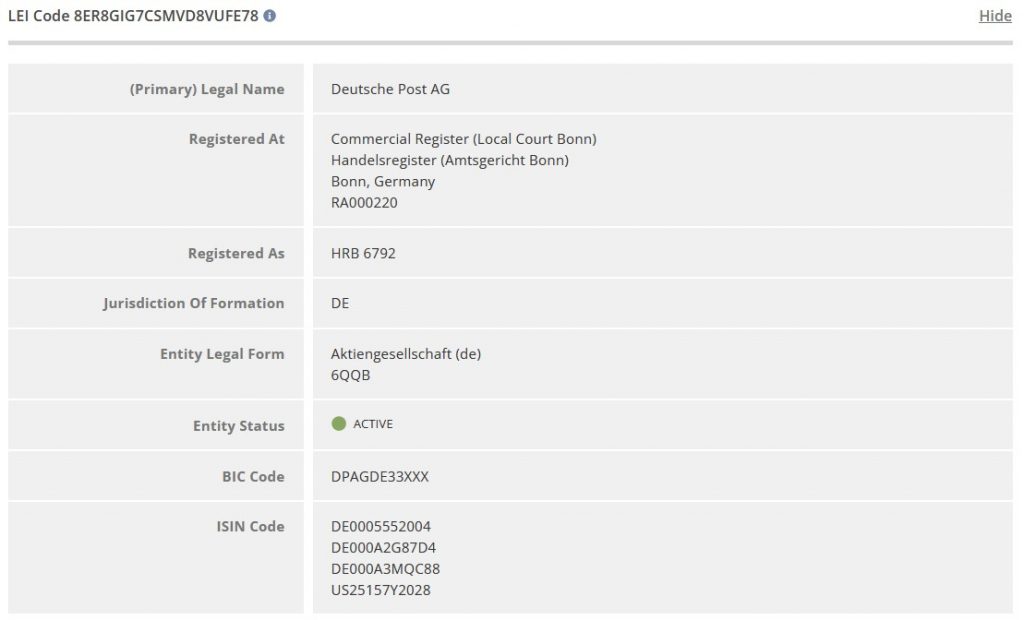

As already mentioned, the new LEI should be retrievable in the GLEIF database after about one day. The following information about the company in question can be found in the GLEIF database:

- Name of the legal entity

- Address of the head office

- Legal form

- BIC and ISIN

- Date of first LEI issuance

- Date of the last modification of the LEI record

- Date of LEI entry expiration or next renewal

- LEI issuer

- Identifier in the commercial register

- Subsidiary

Here is an example of an excerpt from the GLEIF entry of Deutsche Post AG

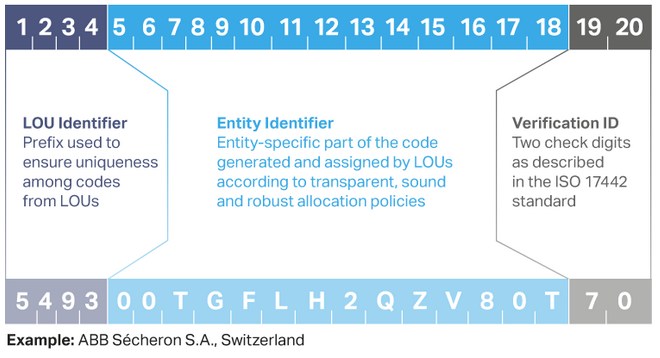

In accordance with ISO standard 17442, the LEI consists of a twenty-digit, alphanumeric code that is made up of various identifiers or IDs, similar to a BIC or IBAN: